Green Enterprises

Climate-related disasters are impacting our lives significantly. In the last decade, several Indian cities /states (Chennai, Mumbai, Kerala and Kashmir) witnessed extreme flooding, resulting in loss of livelihoods and business. Further, frequent droughts and short spells of intense rainfall have impacted agriculture productivity and farmer income.

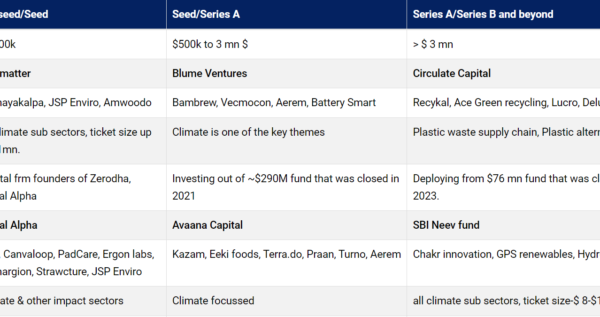

A large number of start-ups and SMEs are addressing climate change via technology and data-driven solutions in agriculture, renewable energy, water, and waste management. Our mission is to assist such companies in accessing capital so that they can scale up their operations and in turn make our world more livable.

We work with companies that are either contributing to reducing carbon emissions or helping in adapting to the impacts of climate change.